Cut Costs, Increase Efficiency, and Reduce Emissions

Sustainability • Published on July 7, 2021

There are two dirty words in the trucking industry which most retailers and shippers prefer not to talk about: “empty miles”. Consider the fact that each year, heavy trucks run 175 billion miles across the US moving truckload freight. Yet, of these miles, 61 billion are actually empty miles — meaning a truck is traveling WITHOUT a load. This unfortunate circumstance contributes to over 87 million metric tons of carbon emissions annually.

The Retail Industry Leaders Association (RILA) recently hosted a webinar featuring Convoy’s Head of Sustainability, Jennifer Wong, and Home Depot’s Ron Guzzi, Senior Manager, Transportation Carrier Relations and Sourcing, to discuss the topic “Cut Costs, Increase Efficiency, and Reduce Emissions Through Freight Matching.” Jennifer and Ron shared perspectives on a variety of topics including freight matching, route optimization, carrier collaboration, and much more.

From Convoy’s perspective as a digital freight network, Jennifer shared data on the evolution of the empty miles phenomenon, how the industry has been attempting to move the needle on empty miles, current strategies to address the reduction of carbon emissions, and ways to offset the rest.

As the largest home improvement retailer in the world, Home Depot faces a host of challenges in its supply chain and Ron shared the building blocks of how they address sustainability efforts, the organization of their supply chain, strategies they have been implementing including floor loading, final mile delivery, direct fulfillment centers, and flatbed delivery markets.

Some of the key takeaways from the webinar follow.

Industry’s Sustainability trends in Empty Miles:

Estimates in the mid-1970s suggest that between 20 and 30% of miles driven by freight carriers were empty. But if you look at the several results between the 1990s to early 2000s, it puts empty miles between 15 to 18%. Since then, there’s really no sharp improvements because surveys from the past decade or so put empty miles in the range of 15 to 20%. So there hasn’t been a lot of improvement of empty miles over time but the significant amount of waste continues to occur.

Difficult to Measure Carbon Emissions:

Convoy recommends the first step in sustainability efforts is to measure your carbon emissions because unless you can measure your output today, you don’t really know the biggest areas of impact to be able to improve upon. Some companies have their own internal systems where they are trying to collect the carbon emissions from all different departments across their entire organization, while others work with third-party consultants. One challenge of sustainability today is a lack of standardization and visibility. Convoy has tried to give more visibility into sustainability data to any customer partnering with them by automatically adding sustainability metrics into monthly reporting.

Identify Strategies to Decarbonize:

One avenue is to more efficiently bundle shipments because if you’re able to bundle shipments, you can actually reduce emissions by 45%. A second way is offering more flexibility with deployment windows. Convoy has done some research and for those who choose a green appointment window — meaning they have flexibility in pickup and delivery times — they can actually reduce emissions by about 36% because they are maximizing the carrier transit time, the carriers aren’t having a lot of time at the beginning or end of those runs so they can actually stay more efficient, and they’re picking up more bundled shipments as well.

Offset What You Can’t Reduce:

Companies won’t necessarily be able to fully reduce every emission in their transportation network immediately, but they can reduce as much as possible and then offset the rest to make an impact. Through a partnership with CarbonFund.org., which is one of the largest credible offset providers, Convoy is now able to give more data and insights for customers to be able to offset their truckload transportation.

How Home Depot Has Modified Its Supply Chain:

Prior to 2007, Home Depot was probably one of the most inefficient retailers in the country. They were, by far, the leading LTL shipper in the country with about 60% of its freight moving vendor direct to store. About 40% of it flowed through its stocking and bulk centers. Fast forward to where Home Depot is today, where over 60% flows through 19 Rapid Deployment Centers (RDCs). 23% goes through its stocking and bulk location, and only 14% now goes direct to store. Things like live goods will never go through a distribution center, and that makes up a good part of that 14%.

Home Depot Manages Their Dedicated Fleet System:

Home Depot does not have a private fleet. They run massive, dedicated fleets with a high priority on reducing or eliminating empty miles. They also do a good job of selling some of their empty miles when they can, and do even a better job of purchasing empty miles from other shippers across the industry that run either dedicated or private fleets. Home Depot runs about 2600 total drivers and approximately 2300 tractors. There is some slip seating and they run just under 200 million total miles each year with the dedicated fleets. Total loaded miles are about 145 million or about 73%

How Home Depot Employs Intermodal Shipping:

Home Depot is definitely one of the largest intermodal shippers. Intermodal is not necessarily eliminating empty miles but it’s just eliminating miles in general because of the fact that you’re moving many 53-foot containers off the same train. So, the fuel and the emissions difference is huge between truckload and intermodal. Home Depot moves about 150,000 intermodal loads a year. Anything that is over an 800-to-1000-mile distance is oftentimes going to move intermodal for Home Depot.

Partnering With Other Shippers:

Three or four years ago Home Depot became very actively involved in working either directly with other shippers or through a company like Elaine Hub, which is now run through Transplace, and purchasing other major retailers or even shipper private fleets or dedicated fleet empty miles. Considering Pepsi and Frito Lay alone, Home Depot has moved over 4,000 loads of theirs simply benefiting from their empty miles moving its freight via a one way. They are a part of Home Depot’s annual national bid and one of the bigger carriers within the Home Depot fleet. Home Depot continues to look at other opportunities to either sell its 50 million empty miles or fill the rest of them by looking at other shippers with the same opportunities to enable the company to benefit from really good costs and at the same time reduce its carbon footprint.

Working To Adapt Final Mile Deliveries:

Currently, and over the next few years, Home Depot is creating very large direct fulfillment centers and flatbed delivery markets. So instead of delivering from stores, the company is going to be delivering things like lumber, building supplies, appliances, patio furniture, and other big and bulky items from these locations. There will be about 150 extra distribution centers or small delivery centers which will be opened up across the country to create the fastest most efficient delivery network within home improvement.

To learn more about Convoy’s carbon emission reductions and how The Home Depot addresses shipments throughout its network, watch the webinar recording here.

Video transcript

(edited for clarity)

Jess Dankert: Good afternoon everyone. My name is Jessica Dankert, and I am the vice president of supply chain for the Retail Industry Leaders Association or RILA. My colleague, Erin Hiatt is RILA’s vice president of corporate and social responsibility, and she and I are co-hosting today’s webinar, Cut Costs, Increase Efficiency, and Reduce Emissions Through Freight Matching. But we will be talking about a lot more than just empty miles today. First, for those that aren’t familiar, RILA is the trade association for the largest and most innovative companies in the retail industry. We bring retailers together to share, learn, and advocate, advancing our members and strengthening the industry. Visit RILA.org to learn more about us.

Today’s webinar is the second in our six-part series on topics at the intersection of transportation and sustainability. Today we’ll be focusing on the transportation and logistics operations of shippers and exploring how sustainability isn’t just a feel-good buzz word in today’s retail supply chain but rather a strategic imperative that yields bottom line benefits while working toward important goals for the environment. As a significant source of emissions, transportation and shipping is a key area of focus and today we will hear from Convoy and The Home Depot on topics like freight matching, route optimization, carrier collaboration and more. I’d also like to thank Convoy for sponsoring today’s webinar. As most things, supply chain and sustainability topics and goals are a journey so whether your company is just getting started with developing goals and strategies or continuously improving on existing journeys, Convoy is a good partner to connect with. And I’d invite you all to visit RILA.org to register for the next webinar in the six-part series.

Erin Hiatt: As Jess mentioned, I am Erin Hiatt, vice president of corporate social responsibility with RILA and I have the pleasure of introducing today’s webinar speakers. So, first off, we are going to hear from Jennifer Wong who is the head of sustainability at Convoy. She sets the direction for Convoy to meet its own sustainability goals as well as helping businesses and carriers ship more responsibly including many RILA members. Then we’ll hear from Ron Guzzi, who is senior manager of transportation carrier relations and sourcing with The Home Depot. Ron has been with The Home Depot for 24 years and his roles have covered a variety of responsibilities with transportation. He has led the carrier relations and sourcing team for the last 10 years, and he partners with more than 200 carriers in Home Depot’s network finding ways to lower Home Depot’s carbon footprint that also yields savings and efficiencies. So, let’s jump right in. Jen, I’m going to turn it to you first. Thank you so much for joining us and for Convoy’s support of today’s session.

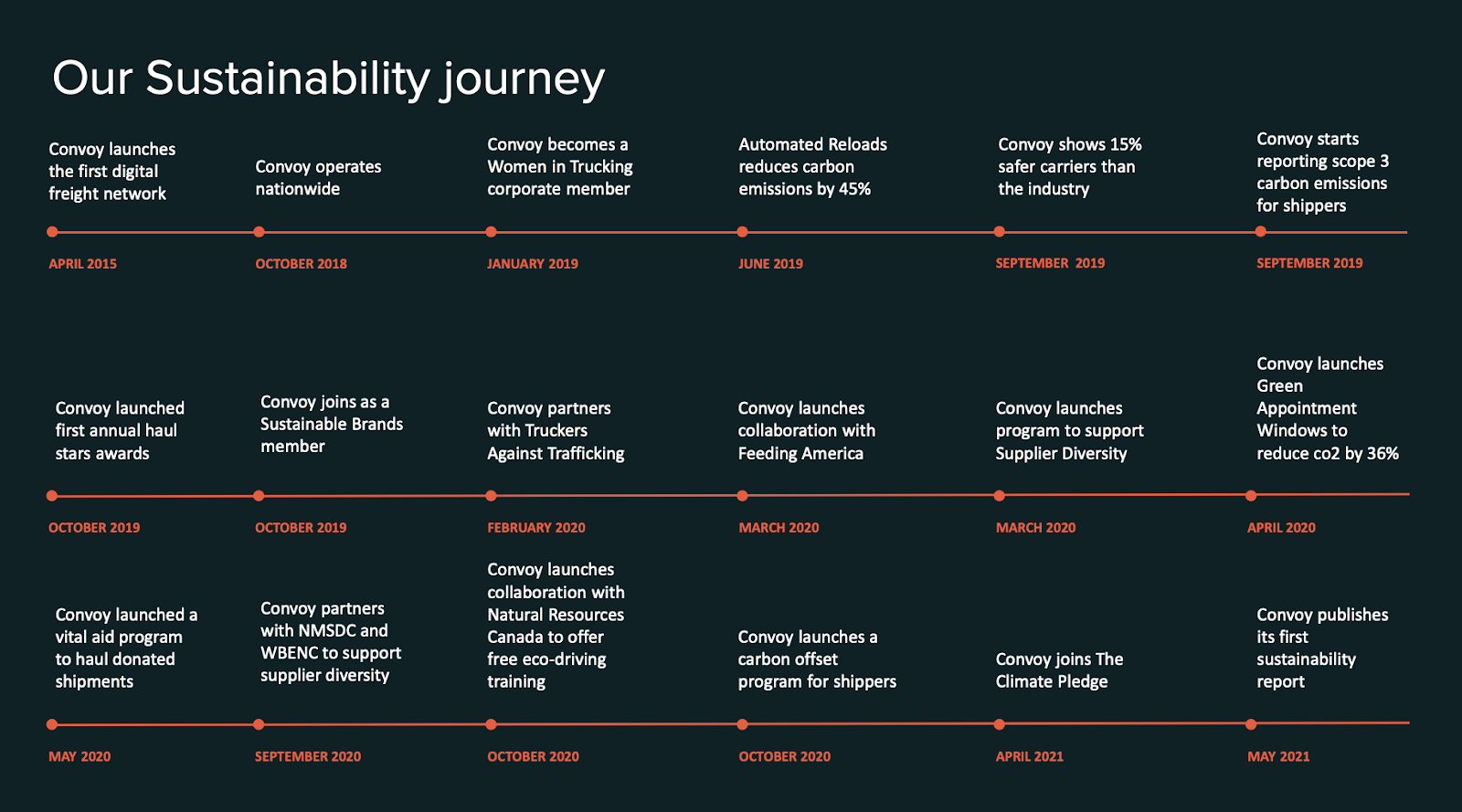

Jennifer: Thank you for having me! At Convoy, sustainability is a part of our day-to-day business. We are a digital freight network transporting full truck load freight for companies of all sizes who really need a reliable transportation partner to get their freight from point A to point B. Our sustainability journey started the very first day of the company. April 2015 is when Convoy first started. I love that Jess mentioned that sustainability isn’t’ a buzz word because it really is true where a lot of the companies that are the leaders in sustainability today are incorporating it into their business practices. It’s not just a program that’s on top of their business today but everything that they launch and invest in around sustainability actually drives meaningful business results as well. Here are some of the highlights around Convoy’s sustainability journey. It showcases some of the products, programs, and partnerships that we’ve launched to be able to better support our customers and every shipper that wants to think about how they can leverage their supply chain partners to ship more responsibly.

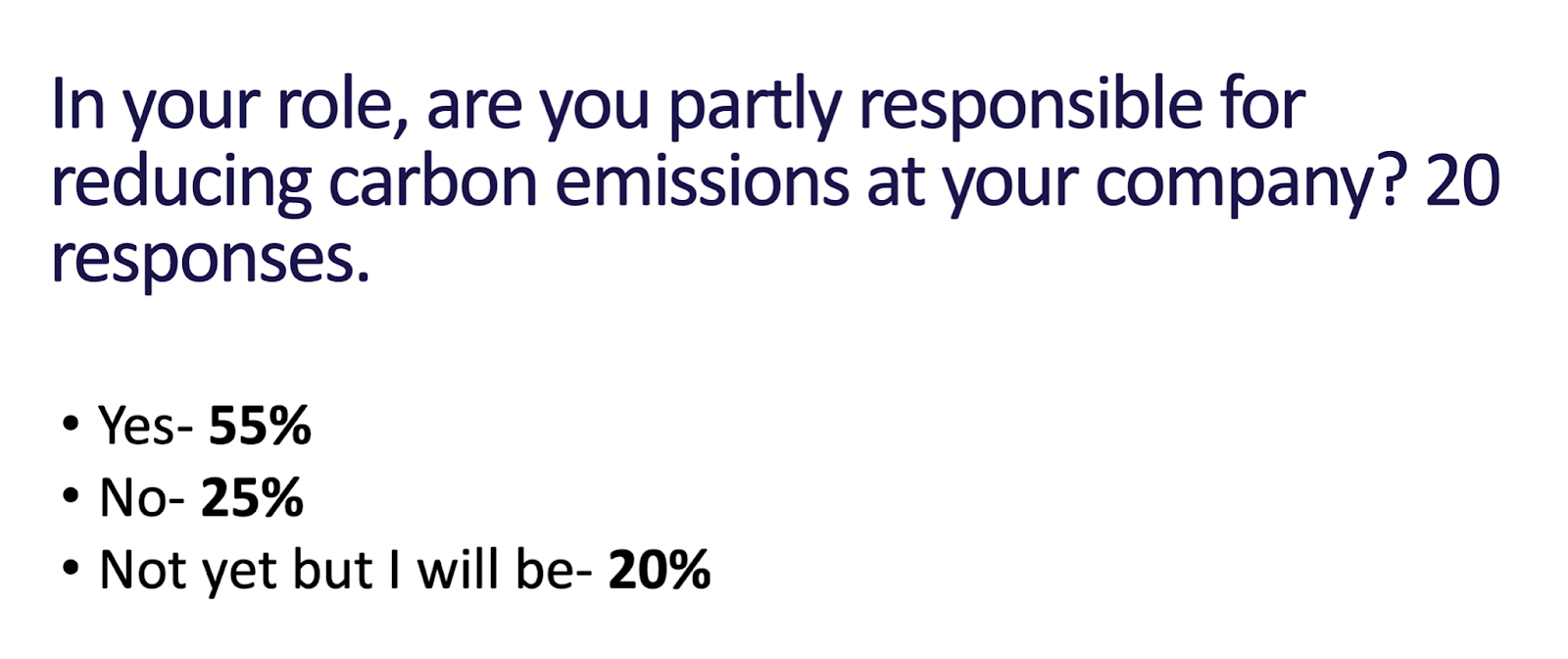

Today there will be a few different poll questions. I have the first one up today just to understand if you’re responsible for reducing carbon emissions at your company.

More than half of you are responsible for reducing carbon emissions at your company. So, excited to have you in this conversation today. Today I’ll be sharing the problem of empty miles and why it exists today. And then I’ll share some of the research that we’ve really doven into around the reduction of empty miles to reduce carbon emissions and then I’ll leave you with three simple steps that you can consider if you’re looking to really take some immediate action to reduce empty miles in your transportation network.

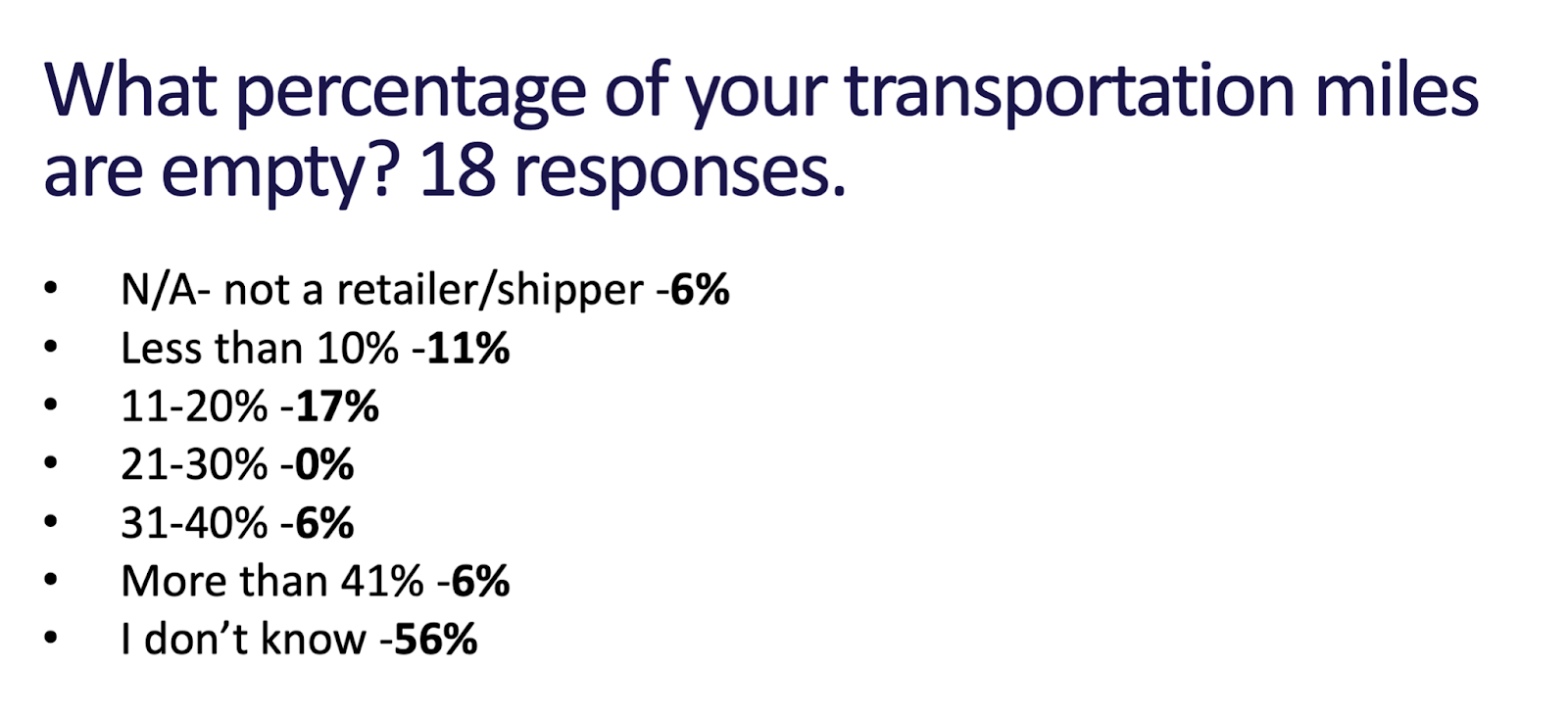

For the second poll question, curious to hear from all of you what percentage of your transportation runs empty today. The Bureau of Transportation’s statistics, they actually see that heavy duty truck load freight accounts for more than 252 million tons of carbon emissions every year. So, if you’re able to reduce that by about 35%, you could see that 87 million metric tons is just due to empty miles. So, it’s a pretty significant problem that have a lot of solutions to be solved for right now.

It’s interesting to see the different numbers in terms of percentages because it kind of follows the trends that we’ve seen when serving estimates in the mid-1970s, they’re suggesting that between 20 and 30% of miles driven by freight carriers were empty. But if you look at the several results between the 1990s to early 2000s, it puts empty miles between 15 to 18%. But since then, there’s really no sharp improvements because surveys from the past decade or so put empty miles in the range of 15 to 20% so you could see that there hasn’t been a lot of improvement of empty miles over time so there has just been so much waste that has been incurring over time. And if you look at a chart like this, at first glance it does look like asset-based carriers drive more of their empty miles than maybe private fleets or independent carriers, but there are a lot of differences between kind of the mid-size, larger asset carriers versus the independent carrier owner/operators. So, it’s a little bit of an apples to orange comparison. But one thing that we did is actually take a look one step deeper. So, in an attempt to control for some of those differences such as the types of trucks and trailers that different carriers run, you can see the differences in empty miles quickly disappear. So, if you only look at the carriers operating a class 8 dry van and reefer trailer, the total share of miles running empty if you look at the 2002 data, from this data, you can see its about 32% for mid-size to large asset-based carriers and independent operators are about 35%.

The first step is to first measure your carbon emissions because unless you can measure your output today, you don’t really know the biggest areas of impact to be able to improve upon. Our four types of scope emissions, scope one, scope two, scope three, scope four, and you can see transportation is actually in that scope three category. And it’s pretty meaningful because if you look at most companies’ scope three emissions today, it involves their entire supply chain, their value chain, so typically the emissions in that category are bigger than scope one and scope two combined.

Some companies have their own internal built systems where they are trying to collect the carbon emissions from all different departments across their entire organization. We know that some companies work with third party consultants. One challenge aspect of sustainability today is a lack of standardization and visibility. One thing that we’ve tried to do is give more visibility into sustainability data to any customer that is partnering with Convoy. So, we automatically add sustainability metrics into monthly reporting. Here is a snapshot example here but we believe that it’s important to be able to see these metrics alongside of the other operational metrics that you would typically care about on a month-to-month basis. There is a lot of different ways to collect this data but the first thing is to be able to look for different partners, whether its internal partners to build your own system or external partners so that they can give you the data to measure your emissions first.

The second step is to look for strategies to decarbonize. There has been a lot of conversation around decarbonizing the supply chain and specifically transportation. Typically, when we are working with different shippers, they are really centering it in two different ways. One is around trying to more efficiently bundle shipments because if you’re able to bundle shipments, you can actually reduce emissions by 45%. So, in that initial scenario, instead of trying to work with a person that is trying to get the best take or margin for the day, being able to really look at a wider network and more opportunities to find the best positioned truck for any given shipment. Because if you’re able to do that, you can actually reduce carbon emissions by 45%. And then the other way that a lot of companies are taking advantage of are offering more flexibility with deployment windows. When we’ve done some research and looked into this data, if you choose a green appointment window, meaning you have flexibility in pickup and delivery times, you can actually reduce emissions by about 36% as well because you are maximizing the carrier transit time, the carriers aren’t having a lot of time at the beginning or end of those runs so they can actually stay more efficient and they’re picking up more bundled shipments as well.

And then finally, the third is to offset the rest. So, we know that you won’t necessarily be able to fully reduce every emission in your transportation network immediately but reduce what you can and then offset the rest because offsetting really makes an impact. And this is something that we believe should be considered throughout the entire scope three value chain. Some companies today are thinking about offsetting their own emissions, their scope one and scope two emissions, but because scope three has the biggest impact, we believe that scope three emissions should be counted and offset as well. So, it is something that we also offer. It’s through a partnership with carbonfund.org. It’s one of the largest, credible offset providers so a lot of our customers were already partnering with Carbon Fund to offset their emissions, so we also partnered with Carbon Fund to be able to give more data and insights to be able to offset their truckload transportation as well. So hopefully those are quick, actionable takeaways that you could consider when you are thinking about some next or small steps to be able to reduce the carbon emissions in your transportation. Thanks, Erin.

Erin: Excellent. Thank you so much, Jen. Some excellent insights and really great research to share. So, next up we’re going to hear from Ron with The Home Depot about some of the strategies that they’ve been able to deploy and what’s been working. Ron, I’ll turn it over to you.

Ron Guzzi: I am Ron Guzzi, I lead our carrier relations and sourcing team within Home Depot and 24 years with the company. You go to the next slide, Erin. So, I’m going to start with just giving a high-level overview of Home Depot. I think most of you, if not all of you, know who we are. We’re operating over 2300 stores, the largest home improvement retailer in world. Half a million employees that we have and as many of you know, and we appreciate your shopping at Home Depot, sales have been booming. Just in Q1 in this past quarter that we just announced, 32.7% sales growth over the prior year which is beating plan by over 9 billion dollars. So definitely keeping me and everyone else within transportation busy. A little bit about our supply chain, we have approximately 70 DCs, 19 of which are RDCs, so rapid deployment centers. And over 60% of everything we sell flows through those RDCs. We have over 5 billion dollars of total transportation spend across both upstream and downstream. So that includes our final mile delivery portion of our business and then within the world that I measure, or manage, it’s about 225 domestic carriers within our network. We do consider ourselves to be an asset based shipper, we still do business with third party and brokers but highly prefer to use or to benefit from the carriers that are investing and purchasing tractors and hiring their own drivers. A little bit about our sustainability efforts and some of the results, really proud of that fact that we reduced carbon dioxide emissions by 10% in 2019, that was despite about 4% more transportation volume. But to cut emissions by 10% was impressive. A lot of that came from increasing the amount of cube. So just really filling up trailers with that much more stuff that we move. It took about 10,000+ truckloads off the road and also eliminated about 15 million miles of truck roads. Sorry, as I turned off my phone while I was speaking. We also have been a multi-year winning of the large shipper SmartWay award from the EPA. So, we take a lot of pride in what we do tied to sustainability. And just an interesting fact is if you want to do business with Home Depot within the world of domestics trans, you have to be a SmartWay certified carrier. We will not onboard you or do business with you unless you are part of the SmartWay network, and you are staying current by submitting your data each and every year with putting efforts into truly doing everything you can to reduce your carbon footprint.

So, just to give you a visual, this is our distribution network today. And you can see based on the different type of DCs we have, about 70 or so, there is a couple that are missing from here that support miscellaneous type business that’s inside of Home Depot. But the important part is the bottom right. You can see back before 2007, we were probably one of the most inefficient retailers in the country. By far the leading LTL shipper in the country with about 60% of our freight that was moving vendor direct to store, right? And most of that was happening obviously via LTL. About 40% of it flowed through our stocking and our bulk centers but then you fast forward to where we are today, over 60% flows through those 19 RDCs. 23% through our stocking and bulk location. And only 14% goes now direct to store. Things like live goods that will never go through a distribution center, makes up a good part of that 14%.

So, a survey question and you can answer as many of these that apply. So how many of you operate, you know, looking for dedicated fleets? And then of that, those dedicated fleets, you know, how many of you are focusing on filling empty miles and even purchasing or selling your empty mile? Or if you don’t know for sure, you can definitely respond back. So, if you could take a second, you can check all that apply. And just a little bit obviously about Home Depot, we are certainly a retailer that focuses a lot on the dedicated fleets that we have within the core business. We do not have a private fleet, but we run massive, dedicated fleets with a high priority on reducing or eliminating empty miles. We also do a good job of selling some of our empty miles when we can, and we do even a better job of purchasing empty miles from other shippers across the industry that run either dedicated or private fleets. So, let’s take a look to see where we end up. Okay, looks like a good part, 40% of you run either dedicated or private with the same focus on empty miles. Not many of you actually selling your extra miles and very few, it looks like zero of you are purchasing empty miles. So, we follow an anomaly within the call but let’s go to the next slide and we’ll talk a little bit about Home Depot both sells and buys empty miles.

This is our dedicated network. You can see we run about 2600 total drivers. About 2300 tractors. So, there is some slip seating that we do, and we run just under 200 million total miles each year with the dedicated fleets. If you look at the total loaded miles, it is about 145 million which is about 73% but if you look at the cartoon or the graphic below, you can see from the DCs to the stores, that contributes to about 79 million miles. So, when we return back from those stores, about 25 million of those miles are loaded with pallets. So, pallets that are obviously being gathered from the stores with all the inbound freight and then they are loading up an empty trailer. And every couple three days or so, we’re going to bring that trailer back to the DC when one of the stores get one of their next deliveries. We also have about 2 million miles that we are selling our miles to third parties. So, our carriers are working with other potential shippers. So about 2 million miles are running in parallel. We’ll pick up from a vendor and maybe bring it back to another shipper’s distribution center. And then biggest bucket is the 39 million miles that after we drop off at a store, our driver is going to a local vendor picking up that vendor load and bringing that back to our DCs. So, when you tally all that up, it’s about 84% of our store loads that are coming back with freight. So, we do a pretty good job of maximizing out. The reason why the math doesn’t completely add up is because the dedicated fleets are often times driving empty to a local vendor and then brining that back, obviously driving empty is going to be part of the empty miles that make up the overall 73%.

So, survey question number two, we do a lot with intermodal. Curious to know of the retailers that are on, how many of you also work with intermodal within your network. I can say for us, we certainly want to make sure that it’s the cheapest option. We do an annual bid each year in which we will bid both truckload and intermodal together. More times than not we’re going to award it to the better of the two cost options inclusive of fuel. And then the questions on service, we feel it is absolutely a better capacity option. We don’t feel, especially current state, that the service levels are as good. Not necessarily that it takes longer on transit, but even the very ability against that state of transit is less consistent than we see on the truckload side. There is some concern and risks that we face in terms of service levels and if you don’t know or don’t use intermodal, we can definitely check that. So, let’s take a look and see what results we see. Okay, so again, about 36% of you that are on the call use intermodal. Certainly, focus on whether or not it’s the cheaper option and no response really on the service concerns but we definitely have an active voice, and we are always trying to balance what makes sense in terms of that fine balance between cost capacity and service. So, you can go to the next slide.

A little bit about intermodal, we are definitely one of the largest shippers. Intermodal is…I’m not sure if it is necessarily eliminating empty miles but it’s just eliminating miles in general because of the fact that you’re moving many 53-foot containers off the same train. So, the fuel and the emissions difference is huge between truckload and intermodal. We move about 150,000 intermodal loads a year and I would say everything from vendor going into DC probably makes up about 35 to 40% of our total spend, of our over the road is going to fall within the world of intermodal. So, anything that is over an 800-to-1000-mile distance is often times going to move intermodal for Home Depot. The other thing that I’d say three to four years ago that we’ve become very actively involved is working with either directly with other shippers or maybe even a company like Elaine Hub who now is run through Transplace and purchasing other major retailer or even shipper private fleet or dedicated fleet empty miles. Just talking about Pepsi and Frito Lay alone, we moved over 4,000 loads of theirs simply benefiting from their empty miles moving our freight via a one way. So, they are a part of our annual national bid and one of the bigger carriers now within our fleet. And their performance is actually very strong. We do some business with a few others that you see listed on there and we continue to look at other opportunities to either sell our 50 million empty miles, so as much as we move a lot of unloaded, we have plenty of opportunity to fill the rest of them and we are also looking at other shippers that have those same opportunities in which we can benefit from really good cost and at the same time, really look to reduce our carbon footprint.

Floor loading is not new to the industry. We started floor loading from our DCs to our stores several years back and with that we got a benefit about reducing or eliminating about 25% of the loads that were moving from the DCs to the stores. Simply because we’re just putting more stuff in the trailers. You can see the before and after, right? When we were running about 2,000 cube and now fast forward to where we are now, we’re jamming everything to the gills, right? Very little pallet loading and literally floor stacking freight from floor up to ceiling and getting 2500 to 3000 cube. It’s also very efficient for the stores. It does take a few hours to unload the trailer but they’re loading on carts and brining that freight directly to the aisles to which they’re going to be packed out mostly at nighttime or so. So very efficient operation. The stores like it because they are actually now receiving less trucks per week. It has taken about 25% of the inbound truckloads away from the store each week and obviously, as you can imagine, saved us a lot of money in doing so. Okay, you can go to the next slide.

And I think this is, okay, I’ve got two slides left. So, regional fleet has also been a big part of our network. Just to give you an understanding of how regional fleet differs from either one way over the road versus our dedicated fleet, the top two graphs or pictures show two separate one-way lanes, right? So, an RDC that was running to two separate stores and because of the distance, one of those stores was running dedicated. The 1059. And the other one was to a vendor running one way. The same thing with the picture in the top right, shows that we were running both of them with one-way carriers. So very transactional. Probably a lot of empty miles that was built within that and what we did is we turned those, what used to be one-way lanes, into a regional loop. So, it’s a driver who is obviously picking up form the RDC and running to the stores, in between picking up a vendor, and that continuous loop is an example of what we have scaled across the country in which we runt these regional fleets, about 200 trucks or so. Not only do they save money, they reduce empty miles. These fleets usually run with less than 10% empty miles. I refer to it as connecting the dots. It could be partial dedicated loads. It could be one-way lanes. In the end, the drivers are running very consistently. They are on the road for I’d say, five days at a time. Very predictable freight. They know where they are going to be each day of the week and for the most part, many of these drivers are going to have the weekends off. So, let’s say they are on a Monday morning by picking up a load, they get back Friday afternoon or early evening, they sit down, take their two-day break, and they are back out again on Monday morning. So very low driver turnover. Drivers love it. It’s a much more consistent over the road lifestyle. And then from a distribution perspective, really good with better service, right? Much more predictable and we can count on this capacity and then less trailers because we have so much of this freight running with the regional fleets that we manage and therefore less one way over the road carriers that clutter up the yards with a lot of trailer pulls within those already ceased. So, we have about 200 trucks and we expect to add about 50 trucks here in the next 12 months or so. So, a lot of growth within this area.

A little bit about our final mile. You can imagine, especially during the pandemic, Home Depot final mile or delivery has been booming. So, everything from parcel to especially box truck, van delivery, and even flatbed, you can see there with the forklift on the back of it. So just to give you an understanding of how we are reducing tons of empty miles and running this business much more efficiently as we convert over the next couple of years going forward is the prior state was about 2000 stores in the US and every one of those stores delivering to residential or pro customer. So, you think about it, we’re delivering freight into the store, product is being put on the shelf, and then we take it off the shelf, load it on to a delivery truck, and deliver it to the customer, times 2000 stores so you can understand how inefficient it is. And then obviously the miles and the extra emissions that are happening because of the 200 stores that we’re covering. Fast forward to where we are now and over the next couple three years, we are creating these very large DFCs, direct fulfillment centers, and flatbed delivery markets. So, market delivery type operations and we’ll still be delivering to some remote stores that will still be delivering still to customers, but this will be a centralized delivery network. So instead of delivering from stores, we’re going to be delivering from these locations. So, things like lumber, and building supplies, appliances, patio furniture, and other big and bulky will go through this network and we expect over the next two to three years or so, we’ll be complete with this. It will be about 150 extra distribution centers or small delivery centers that will be opened up across the country. So, creating the fastest most efficient delivery network within home improvement. And I think Erin, that is the last slide that I have. But as you can all see, a lot of that happening with Home Depot and much of that is tied to our efforts in reducing our carbon emissions.

Jess: Well, that was fantastic. Thank you so much Ron and Jen as well. So much good information. Okay folks, if you do have some questions, we’re rolling in on the Q&A. Jen, can you talk a little bit about, you know, working with the number of shippers that you and Convoy do. Can you talk a little bit about some of the trends you’re seeing in terms of where shippers and particular retailers are at in their kind of journey and looking at either beginning to assess, you know, what their impacts are on particularly empty miles. How far along they are in that journey and maybe some of the surprising lessons learned from that. I know we saw from the survey that people are in various stages with a significant number not necessarily knowing about empty miles. What do you see that kind of continuum of folks and what are those conversations?

Jennifer: The poll questions during this webinar have been reflective of what I typically hear in direct conversations with shippers and specifically retailers where there is a big range in terms of where a company is at in their sustainability journey. Within the last year, more and more shippers are actually coming to us asking about sustainability, specifically because they’re now tasked to reduce carbon emissions. 55% say that they have responsibilities to reduce carbon emissions, that’s actually showing up in direct conversations as well. But because a lot of transportation leaders aren’t sustainability experts, they’re now given this initiative to kind of say, “Our corporate sustainability goal is to reduce carbon emissions by 50%.” And they’re like, “Great, we’re going to do this.” And they want to be on board, but they just don’t know where to start. It’s a great collaborative conversation that every business should have with all of their supply chain partners because supply chain is so interconnected, you can’t just work with one partner to provide that solution. You actually need to be able to have these conversations with all partners and really ask them how they can help you because the reason why companies haven’t addressed their scope three emissions with their supply chain is because they don’t have direct ownership over those emissions. So, they actually do need to rely on supply chain partners to ask for advice, or help, or some new ways to partner to be able to meet some of those goals. So, I’m really excited to see some of the progress in this area, to have a little bit more attention to reduce carbon emissions because I am seeing it come up more and more often just in conversations.

Jess: Great, thank you for that. Ron, Jen touched kind of a little bit on collaboration aspect and where they’re seeing now noticeably more people coming to them to start having these conversations. From The Home Depot perspective, can you talk a little bit about internally from Home Depot how those collaborative conversations, you know, cross-functionally, how those collaborative conversations work and how you guys got started earlier on in the process and how that process evolved in terms of working within the sustainability function, looking at the corporate wide goals, and how that plays out on the operations side. Can you talk a little bit about how that process looks at Home Depot?

Ron: Yeah, Jess. So, I’ll start by saying we do have a sustainability team, right. It’s not just about transportation or carbon emissions, but overall, we look at sustainability throughout the company. So, we work very closely with that team in terms of collaboration. One of our value wheels is doing the right thing and we do feel that obviously everyone kind of taking or doing their part within sustainability or reducing emissions is the right thing to do. We have a very large data analytics team within Home Depot. It was shocking I think when we did some of the analysis and showed that we had far over 50 million miles of empty miles that were coming back, right. And when you start putting maps to that and realize how much we were spending on simply moving air, or you know, dropping freight off and coming back empty. So, I think the collaboration, a lot of it was internal in what ways can we just within our own network benefit from those empty miles. And as a lot of you saw, a lot of it is simply brining back either return to vendor type freight or pallets, or everything we can do to maximize our vendor network within that 250-mile radius or. Over the past three years, I can say that we’ve taken that collaboration to some of the other shippers in the industry. You know, Pepsi as I mentioned, and Frito Lay are two of the biggest ones. You know, there is nothing easy about filling either their miles or your miles because there is some risk involved. I mentioned detention time. We were very nervous about the idea of using someone else’s miles because we’re at the mercy a little bit of maybe their network being inefficient, right. We move freight with their dedicated fleets and if they have detention time or delay, then we’re negatively impacted. So, there were some pessimistic folks that maybe didn’t want to necessarily go down that path. And the same thing with selling our empty miles. If we’re moving someone else’s freight that is not running as efficiently as we are, then there are the same risks. So, there was a lot of collaboration, we’re trying to work with other like type shippers that operate especially a drop and hook type network, so we don’t necessarily have to be at the same risk of the detention time that many have to endure. So, if we find other type like shippers, especially retailers that are moving time sensitive freight, it puts us in a much better position to be successful for them and for them back to Home Depot. So, a lot went into it, and we still have a lot of work to do. As I mentioned a couple times, over 50 million miles that are still empty so it’s a journey, it takes some time, and it definitely takes some effort. And we do have somebody within our analytics team that is more or less dedicated to this continued effort, so it keeps that person busy as we continue to find ways to expand.

Jess: Yeah. Thank you for that. I recall a supply chain executive saying that empty miles are a great opportunity but it’s not for the faint of heart. Maybe if you can talk a little bit more about kind of how that relationship looks particularly in the case of the examples where you’re buying and selling those empty miles. You know that collaboration piece. How it looks around the relationship, the data exchange, and that aspect to it. How do you get started on these types of things?

Ron: Yeah. I’ll start with, and maybe focus most on the very strong success that we have with Pepsi and Frito Lay. So, it definitely starts with what you just mentioned, right. It’s a data exchange and an NDA that we both understand that its sensitive information and it’s really just lying our network on top of theirs and looking for those synergies. And, you know, they participate in our national bid and vice versa and a lot of it is as simple as that. It could be looking at lane level opportunities for theirs in which we move 4000 loads with them. When we launch our national bid, which is a billion dollars of annual spend, they are one of the carriers that’s placing rates, no different than the other trucking companies that are out there in the country. So, it’s very easy for them to see all the opportunities that we have, compare it with all their empty miles, and find the right fit. I mentioned that we do work with Lane Hub, which is now part of the Transplace network, and they are serving as kind of the conduit between us and many other shippers, whether its Walgreens, Coca-Cola, whoever else that they may partner with. So, as we go to bid our entire footprint of freight, they can now participate on behalf of some of those other shippers to find ways of filling the empty miles that we have or filling some of the loads that we have within our network. So, the faint of heart sounds very familiar. Some believe that maybe it was at Home Depot at one point and like you said, there has been nothing easy with this. It sounds great on paper, but it takes a lot of collaboration and focus to make it work. And finding a lane or two, it might save 20,000 dollars a year, but that’s how it starts. And since that time, its built into multiple millions of dollars of savings and obviously tells a great story in terms of emissions reductions.

Jess: Jen, I know that at Convoy you guys see a lot of this and work with a number of shippers. Can you talk about facilitating that type of collaboration and that communication and some of the wins that you guys have seen in working with shippers and how that has ultimately improved some of the operations on the shipper, retailer side?

Jennifer: One that comes to mind is one of our larger retailers that we work with, during their RFPs, when they submit the RFP, we take a look at their lanes and similar to what Ron said, we actually look at a lot of their lanes we feel like we have a high confidence level to batch. And we know this because we are running freight for other shippers in the network. So if we see an opportunity to be able to batch that potential lane, we’ll actually flag that in a freight RFP and take a look at those specific set of lanes which will be a percentage of their entire RFP and a percentage of what we actually win on, and flag them to say if we actually win these specific lanes, we’ll be able to save you this amount of carbon emissions and well as this amount of potential savings on the freight because we’ll be able to run it more efficiently. So, it’s a similar kind of lane network overlap but it’s done a little more anonymously because for us, we aren’t looking at specific other partnerships. We’re actually just looking at other lanes that we’re also running to be able to pair those together. So, for the direct shipper that we work with, we don’t have to look for round trips, but we actually look for that other leg of the round trip for them. And that’s been pretty helpful just to be able to give that visibility so that as their making choices in carrier selection, they can take that into account as well especially if they are, this year, kind of bonus on reducing empty miles and this specific retailer that I have in mind, their transportation team actually receives incentives, so personal bonuses, that they are able to reduce empty miles with in their own transportation network. And this also happens pretty effectively for ongoing mini bids, if they have other lanes throughout the year, just always being able to give that extra data to not only show the operational metrics and service levels we provide, but where the areas that we can help them be more efficient, which just have more mutually beneficial outcomes as well.

Jess: That’s great. Thank you. Sorry, was there a question?

Ron: Sorry, Jess. I was going to chime in and just not necessarily give Jennifer a plug, but we do business with Convoy and I can say that, you know, the way that they freight match and try to find whether, its moving our loads and then pairing up with maybe other shippers within their network, the thing that I can say with complete confidence is that they do it very successfully in terms of very consistent capacity and very strong on-time deliveries. So, when they are pairing that up, they’re obviously finding those matches. We know that about 35% of drivers across the country are experiencing waste, whether its detention time or just not having freight to kind of connect those dots efficiently. So, I will tell you that we’re working with Convoy and a couple of the other digital carriers, we see some very good success in some of the examples that Jennifer mentioned.

Jess: Yeah, that’s great and to your point around, you know, the consistency and around capacity and on-time delivery, those are pretty important things. So, something that is definitely a big factor in decision making around them for sure. And Jennifer, you highlighted a couple of great kind of leading practices or lessons learned around looking at kind of how to incentivize this type of activity and then also from the shipper’s side, try to think about incorporating this into that RFP process and things to be thinking about on that side. Anything you’d like to add on that, or other things shippers can be thinking about if they’re kind of coming into the process or getting started on these things? Jennifer, did you?

Jennifer: For us it’s really just being able to use data in this new way. I think what showed up in poll survey is just showing that a lot of people don’t have visibility into this data today. But if you are working with carriers that use data as a part of the way that they’re doing business that they’re operating, they should be able to provide you metrics as well. So, sometimes it’s as simple as asking for those additional insights but it’s helpful to make a little bit more informed decisions for your business. So, I’d say that would just be my additional tip to be able to look at the data or ask for the data because it should be available for you today.

Jess: Great, thank you. Ron, I don’t know if you know, in terms of the conversations with the carriers and how those conversations happen, how do you the carriers feel about this work? Are they generally positive on this and a lot of good feedback, it benefits them as well?

Ron: Yeah. I mean, a lot of what I talked about, Jess, is definitely things that I think put us in that shipper of choice category, right. You think about just the drop and hook network and how that helps drivers to be much more efficient, right. Burning less emissions, kind of running idle while we’re waiting for loads. And the other thing I didn’t mention but it’s probably a good time to do so, we find ways of incentivizing carriers and obviously a lot of that ties to what we call our Carrier Rack and Stack. One of the elements that we consider is that carrier’s scoring by SmartWay or within the EPA. So, if that carrier is scored best in class, we factor that in, and that carrier gets a bonus or a bidding advantage because they are running best in class in the EPA. So, there’s different ways that we work to make sure that it is very clear to the carriers that we are a shipper that highly focuses on sustainability, and we are looking for best in class carriers and when you give them kind of an extra incentive in the bidding and kind of monetize that, it certainly helps to get the support of our carriers within your network.

Jess: Excellent. Thank you for that. Also, a question on floor loading which you have done, an audience question around what you saw in impact of the carbon emissions because of having heavier weights on the trucks that you were shipping. Did you see any impacts or changes there when you ramped up on the floor loading?

Ron: You know, I’m sure there is because you are running heavier weight. I don’t know the specific data or statistics to it, but I would say the heavier weight that you are running, considering we offset that by give or take 25% plus loads that you take off the road, so I am sure that there is an impact because you are shipping more weight. Right. There is legal limits, 30,000 pounds full in many states and as much as we are shipping more weight, we’re not going over that obviously that state limit. But I think more, by far, more offset by the number of miles and loads that we were able to take off the road.

Jess: Excellent. Thanks for that. And there was also another question around free shipping, and I know you talked a little bit about last mile, maybe if you could just go on for a minute or so into the impact of free shipping and ecommerce. This is also a great plug for our next webinar coming up which I mentioned on the 16th around ecommerce and the impact to emissions goals there. Maybe you could speak a little bit more about kind of that last mile piece and free shipping and the impact there and any of the store replenishment and how that balances out or how you may work with providers like UPS and FedEx of the world on that piece.

Ron: Yeah, and I’m more on the core side but I spent my first ten years or so on the final mile side. I’ll tell you that a lot of the growth that we’ve seen, it was established prior to the pandemic. We had just accelerated never expected the virus from having the affect that it did. So, it’s amazing how we saw that vision of how we needed to get to far before the start of the pandemic. So, when I talk about growth of 20% up to 30 plus percent that we’ve seen, needless to say, our ecommerce business has been looking at 50% or more type growth, right. We have probably close to doubled where we started in terms of the percentage of our company sales that were through ecommerce to where we are now, right, with the huge acceleration in that area. Everything from parcel to car delivery, to van delivery, box truck, flatbed, you name it. So, all these plans were in place but it obviously, it’s helping us across the board in terms of our overall sales as you can imagine because it has become the new normal for many customers, right. Now, instead of going to a local Home Depot store, have gotten very comfortable with having product that’s being delivered. Whether its cleaning supplies from Home Depot or whether its things that…we sell about a million different SKUs through ecommerce verses about 40,000 individual SKUs in a store. So obviously, as you can imagine, a lot of people now have made getting deliveries part of the way that they do business whether it’s in home improvement or any other retailer in the country. So, it just kind of makes the point or proves the point that where we’re going definitely works and its what consumers are looking for.

Jess: Jennifer, Convoy works with obviously many, many carriers. I’d be interested to know where you see kind of carrier conversations around fleet electrification and kind of the trends there and other sorts of alternative fuels and that type of thing. What are you seeing out there?

Jennifer: Convoy works with primarily owner/operators on the smaller side. These carriers typically have less than five trucks with them. So today, the trends are really starting with the larger carriers, even the larger shippers that can really make the investment in alternative fuels whether it’s hydrogen or electric and they’re really starting to run those tests to understand how they can bring those new truck types into their transportation system. And it is a really complex problem to solve because you have some of your freight being run by electric trucks, some by hydrogen, some still by diesel, now there is just a lot of complexity to be vantaged by what truck runs what freight. But for us, we really want to make sure that this truck technology really gets adopted by the long-tailed industry because most of the truck capacity is run by these owner/operators. Typically, your owner/operator, they are not buying the newest truck on the lot. They are typically buying a used truck, but we want to really help with the acceleration of that to make sure that they have access to these new type of truck technologies to be able to drive a lot of the change of what people want to see as the output of these truck electrification that is happening today.