Risk and Uncertainty in Trucking’s ‘Age of Turbulence’

Freight Research • Published on May 3, 2022

This story originally appeared in Convoy’s “The Future of Freight,” featuring 40 thoughtfully curated pages on supply chain disruption, freight procurement, market volatility, and more.

In September 2007, newly former Federal Reserve Board Chair Alan Greenspan published a memoir reflecting on his two decades at the helm of the world’s largest central bank. His transformative tenure, lasting from 1987 to 2006, bore witness to the aftershocks of the sudden end of the Cold War and the euphoria of economic globalization’s raucous adolescence.

Greenspan titled his book “The Age of Turbulence,” a choice that, in retrospect, seems quaint: Almost a year later, turbulence would return to the global economy with the financial market crash of September 2008. The decade and a half since has seen the global economy roiled by a sovereign debt crisis, a U.S. domestic oil boom and bust, a trans-Pacific trade war, a global pandemic, worldwide semiconductor shortages, and, most recently, the first major European land conflict since the Second World War.

In retrospect, it can feel like Greenspan’s “Age of Turbulence” was just the opening act. The world economy is in constant flux; periods of stability are rare and relative.

Most logistics professionals are skilled at navigating their business’ transportation needs through the seemingly endless parade of economic and geopolitical shocks, but familiarity does not necessarily make the turbulence any less disruptive.

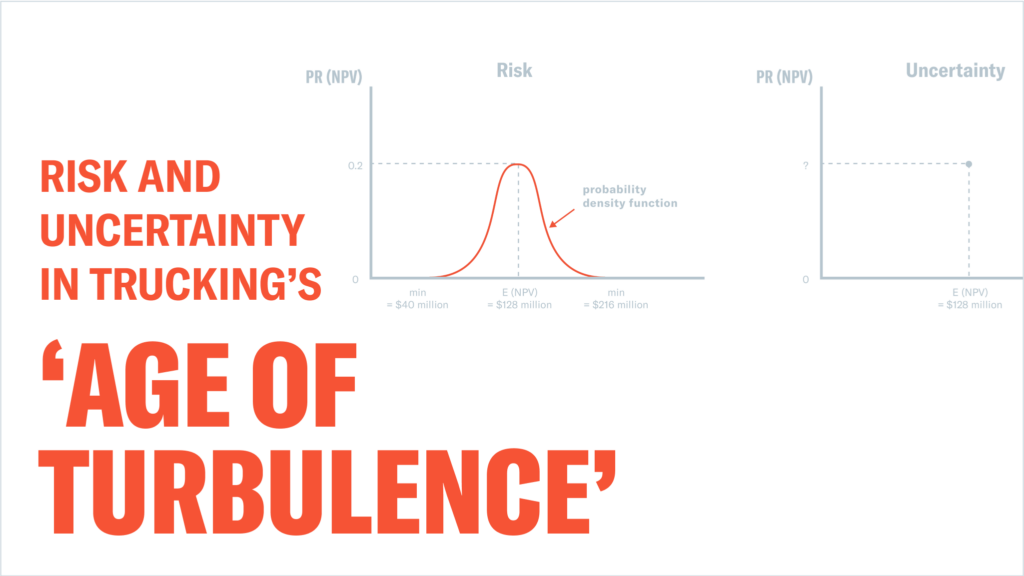

Economists typically distinguish between shocks that are the result of risk and shocks that are the result of uncertainty. Risk events have a stable, known probability distribution — the odds of occurring at a given point in time do not change dramatically over the years. They can be managed. Uncertain events have an unknown or unstable probability distribution. There is little we can do about uncertainty. (This distinction was originally popularized by Frank Knight, a well-known economist at the University of Chicago.)

Uncertainty is sometimes equated with black swan events — outcomes that weren’t even on the radar. That’s an extreme case. More often, uncertainty is less exotic: For example, events with a probability distribution that changes over time (e.g., the risk of a market correction) or events where there is not enough data to identify a meaningful probability distribution (e.g., the risk of very high inflation). It’s not that some subjective probability does not exist, it’s that such events are so rare or so volatile that we have no concrete sense of the odds.

Every age is its own age of turbulence. Increasingly extended and complex supply chains amplify the reach of small vulnerabilities. Navigating inevitable economic shocks requires the combination of active management of risk events with some degree of acceptance of uncertainty.

The promise of technology and data transparency is that gradually, over time, market shocks move from the uncertainty column into the risk column — moving some of the sources of volatility in freight and logistics from the realm of unknown and unstable probability distributions into the realm of known and stable.

It is not an unrealistic dream.

Among the great economic policy achievements of the past 30 years has been the taming of the disruptive booms and busts that plagued the U.S. economy for much of the 20th century, a phenomenon known as the Great Moderation. While the boom-and-bust cycle has not been entirely defeated, cyclical fluctuations in the U.S. economy have become much less frequent. This remarkable success was the result of explicit decisions by policymakers to allow the U.S. economy a greater degree of market-based flexibility: accept smaller and more frequent micro-adjustment but fewer seismic mega-shocks.

Shifting mindsets is never easy, but amid trucking’s most recent age of turbulence, we all can aspire to our own Great Moderation in the years ahead.