FreightWaves May Webinar Recap: 6 Things You Should Know

Shippers • Published on June 1, 2019

Thanks to all who attended FreightWaves’ May monthly webinar, sponsored by Convoy. Below, we summarize the webinar and add insights from Convoy.

Overall, trucking economic data is turning negative, indicating low demand may be here to stay as we enter the peak summer months. On the carrier side, capacity is stretching beyond existing demand and we’re seeing early shrinking.

Demand – Tariff Optimism Is Disappearing Fast

1. Trucking-Related Markets Are Struggling

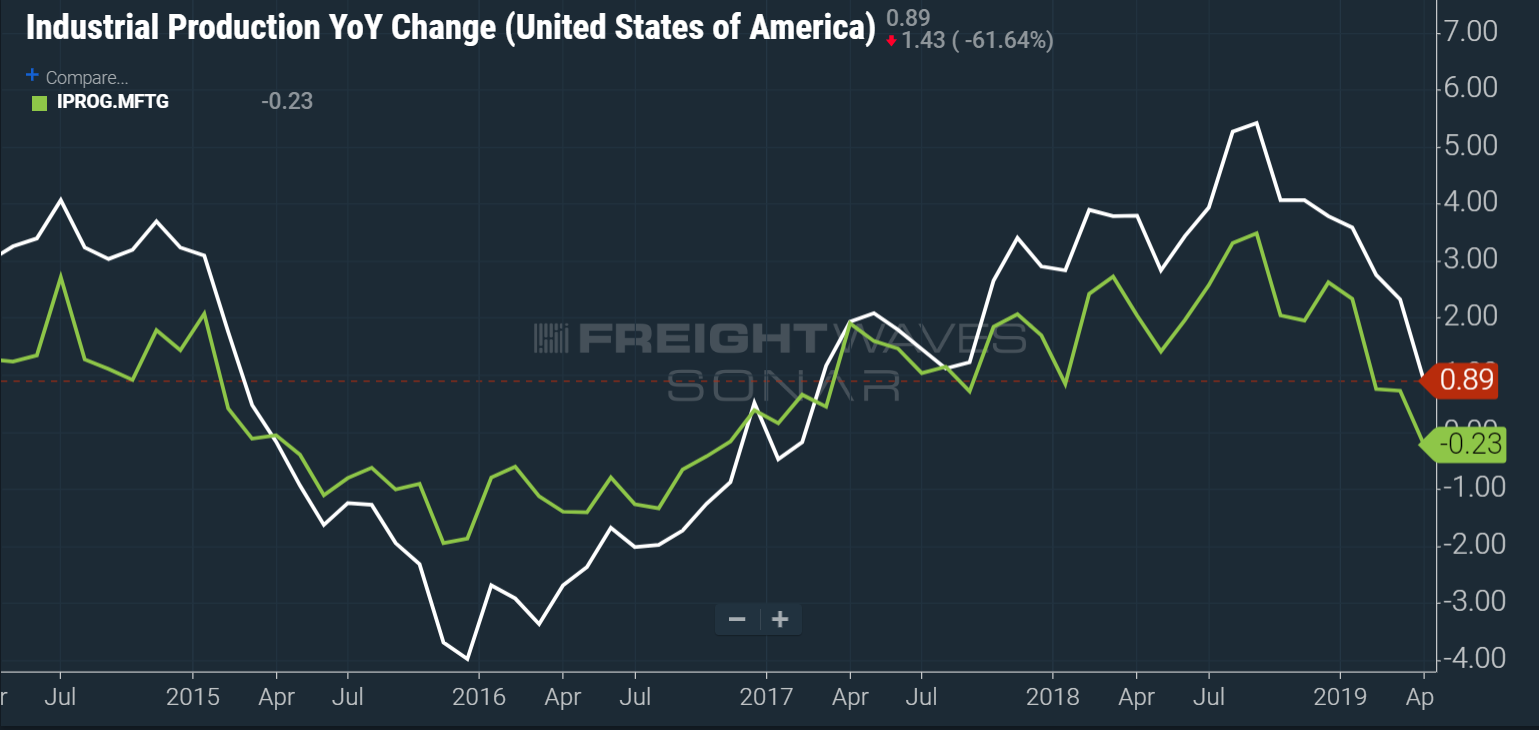

We look to certain parts of the economy to check on the health of the freight market. One major portion is manufacturing, as materials need to be shipped from production to consumers. Last month, Industrial Production: Manufacturing shrank year over year. It has not shrunk year over year since 2016. This is the first time in recent memory we’ve moved from neutral data to negative. This starts to raise our alarms and we will look to see if this is noise in the data or if this denotes a negative trend.

We look at Industrial Production (IPROG.USA) and especially Industrial Production: Manufacturing (IPROG.MFTG) to track how future growth is expected to move for trucking demand. Manufacturing shrank YoY for the first time in 3 years.

2. Coming Down From Optimism on China Tariff Resolution

Tariffs have dominated the headlines over the past month. The seemingly imminent China/U.S. deal has fallen through. While European auto tariffs have been tabled for six months, Mexico has been threatened with a blanket 5% tariff in June. In addition, growth in China and the Eurozone has been slow. This leads to less demand for U.S. exports on top of tariffs. In the long run, it could stimulate domestic manufacturing, but that is a drastic measure that won’t happen soon since factories take a long time to plan and set up.

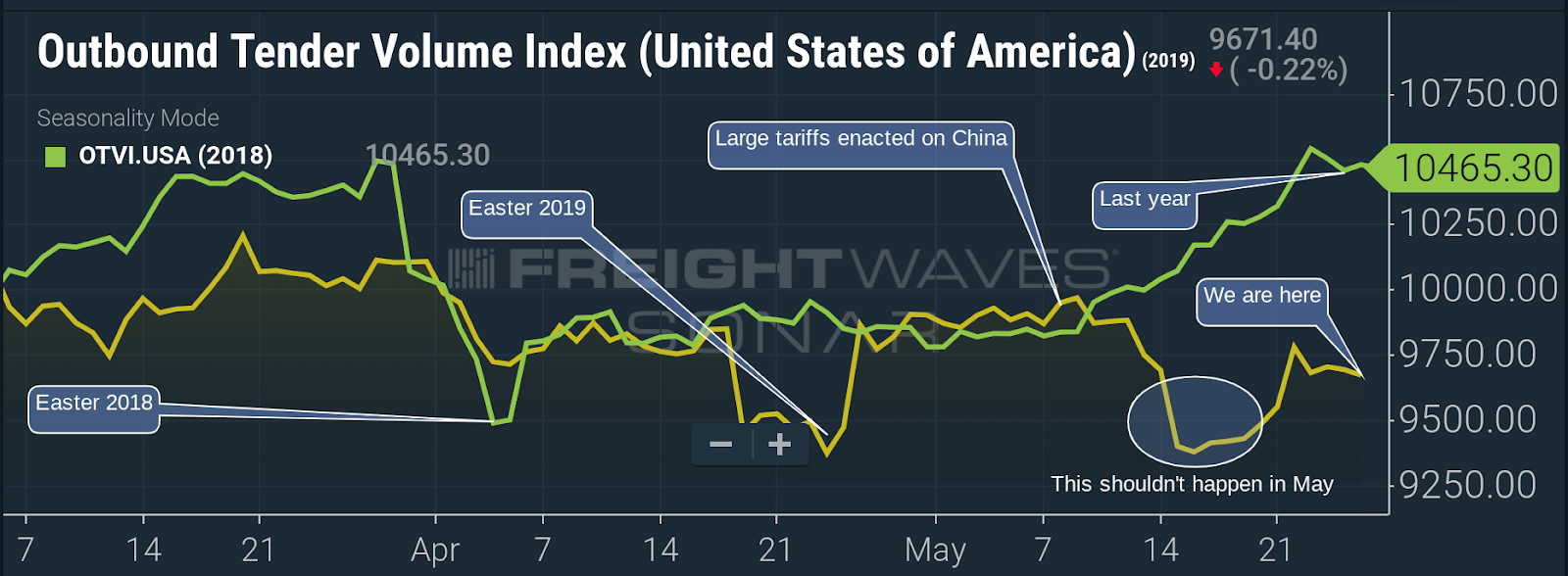

We saw significant optimism in Q1 that China and the U.S. would strike a trade deal. Since then, we’ve seen the market not only come down to earth, but also go further down to offset the Q1 optimism. This can be seen by looking at tender volume across the U.S. We look year over year and see almost identical trends until the recent Chinese tariffs.

This graph shows OTVI.USA for 2018 (Green) and 2019 (Yellow). Other than holidays, things were largely in lockstep until Chinese tariffs were enacted by the U.S. in early May.

3. People Are Starting to Take Notice of the Slowdown

In and out of freight, we’re seeing pessimism and confusion on the horizon. The Fed recently noted they are going to hold off on rate movements while mixed data comes in and there’s uncertainty around tariffs. FreightWaves gathered anonymous quotes across the industry to show what freight peers are thinking.

- Factor: “We are not headed for a freight recession. We are in one already. Not only are rates down by 23%, the amount of freight bills per client is also down double digits.”

- Parcel: “Felt like we fell off a cliff at the end of April.”

- 3PL: “Something is definitely happening. 30% more volume for same revenue.”

- 4PL: “Shippers are forcing freight into the spot market and routing guides are out of compliance.”

- Truckstop chain: “Gallons are down across the board. Carriers are laying trucks over.”

- Large Asset-based 3PL: “Uncovered loads on the book were over 1k on a typical evening, now are less than 50.”

- Top 5 expeditor: “Expedite is dead. Volumes in some sectors of the market are off over 70%.”

Given how freight front runs economic trends, this makes us think the Fed’s next move will be to reduce, not raise, rates.

Supply – Becoming a Carrier of Choice is Key in This Market

4. Supply Has Caught up to (and Surpassed) Demand

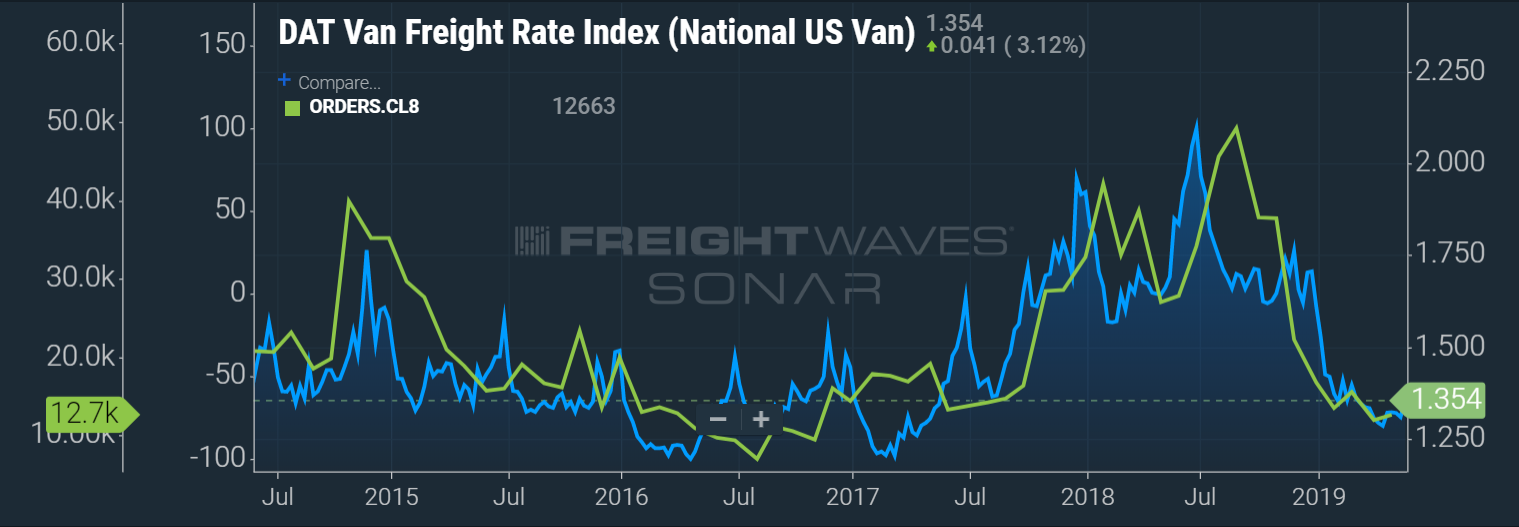

Truck orders have fallen off a cliff since the fall of 2018. They are currently sitting just higher than in 2016, when trucking supply last overshadowed demand. Spot pricing has also plateaued for all of 2019 but should increase coming into the summer months. Staying flat at this time of year is effectively the same as pricing dropping further. We see 2019 looking more like 2016 as the year goes by. Further, trucking jobs dropped for the first time in over a year.

We show the fall in Class 8 Truck Orders (ORDERS.CL8) and the relationship with DAT Spot prices (DAT.VNU). We’ve fallen far from supply shortage in 2018 and are continuing to barely plateau even going into the summer peak season.

5. In 2019, Focus is on Carrier, Not Shipper, of Choice

In 2018, we heard many shippers asking how to become a Shipper of Choice and get favorable rates from carriers during record high rates. The market has turned a complete 180 — now, carriers need to focus on becoming desirable by shippers. Interested in Carrier of Choice? Read our tips on how to become a carrier.

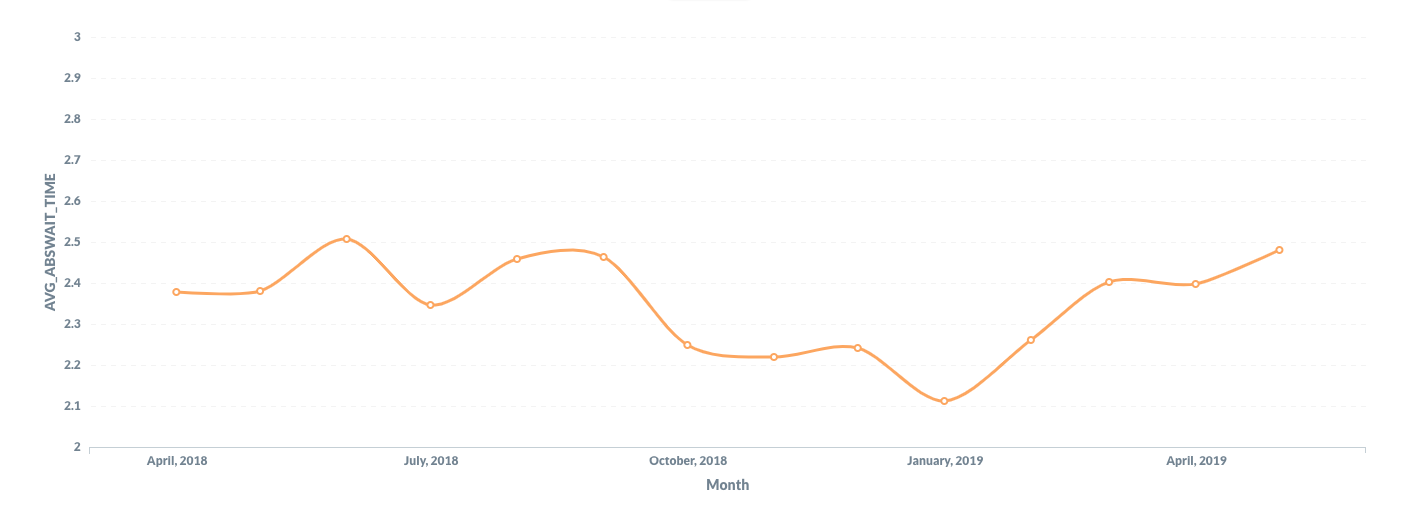

One new development may be patience. We’re seeing that despite volumes on the decline, wait times are trending upwards. Shippers have competing priorities with helping carriers get out of their yard quickly. By having great service, carriers can build great relationships with shippers to get loaded and on the road.

This graph shows the average number of hours a driver must wait before getting loaded at a facility using Convoy data. May averages have increased YoY, but we’ve heard its from lack of urgency from a lack of demand.

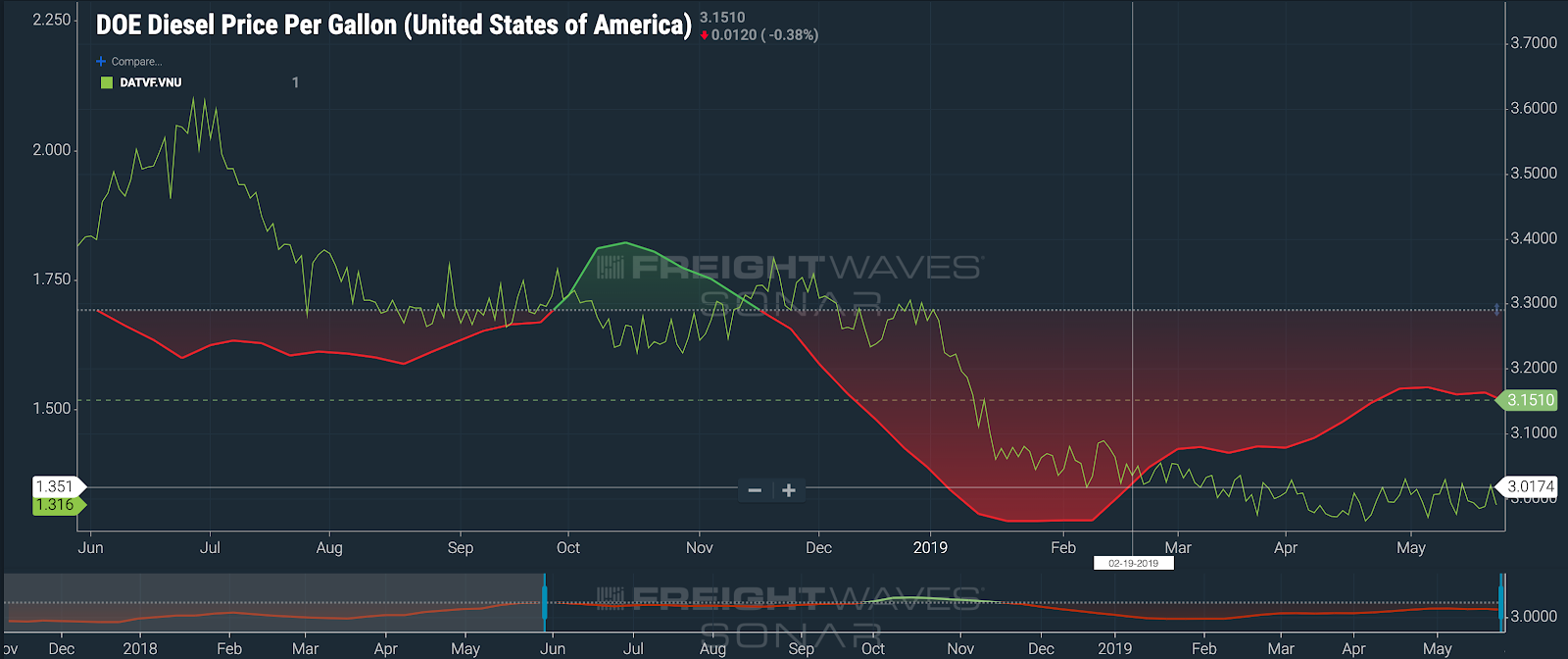

6. Oil Is Slowly Rising

Slowly but surely, diesel prices have been rising since early 2019. Spot rates have not followed the rise at all. This can increase costs for carriers while not increasing revenue. It puts pressure on carriers already struggling to get by with lower spot rates. Hopefully, the summer increase in spot pricing can close this gap and support carriers in these tough squeezes.

Diesel Fuel (DOE.USA) has been slowly rising since February where DAT Spot Rates (DAT.VNU) have been flat. This can put pressure on carriers as their fuel cost rises, but revenue does not increase to offset fuel.

Convoy Recommendations – Become a Carrier of Choice Into Summer

Summer is coming, but volume has not gone up like previous years due to tariff scares and other macro trends. Becoming a Carrier of Choice will help you weather the storm of little freight until demand picks up again.

Shippers should maximize volume going through the primary market so brokers and carriers will be there for you when volume and rates rise again. Building trust with good, high-service carriers should be the priority. Good carrier and broker relationships now will save costs when macro trends increase costs again.

Shippers – Interested in learning more about our industry-leading tender compliance, on-time service, and data-driven insights? Call us at 206-209-0305

Carriers – Interested in a hassle-free experience, automated detention, free quick pay, and unique offerings such as Request-A-Load? Call us at 206-202-5645