FreightWaves: January Market Trends Update

Industry Insights, Shippers • Published on February 2, 2019

Thanks to all who attended FreightWaves’ January Monthly Freight Market Update webinar sponsored by Convoy.

We discussed how economic growth is slowing and is being accented by low demand, which is typical in the first quarter of the year. This is resulting in excess capacity of carriers and spot rates falling off a cliff. The major exception has been reefer trailers, or temperature controlled trailers, which are in high demand to combat the polar vortex in the Midwest.

Below, we summarize the webinar for the demand and supply sides of the market and add insights from Convoy so you can weather these chilly conditions.

Demand – Growth Slowing, Shutdown is Delaying Full Data Picture

The big news over the last month was the longest government shutdown ever. We are feeling the effects now and another shutdown could be looming on 2/15.

While government workers will receive back pay for the shutdown, contractors and other jobs are not, reducing consumer spending. Some of these effects we can’t see yet as various government bureaus paused publishing data and now have a backlog. We see consumer spending decrease overall.

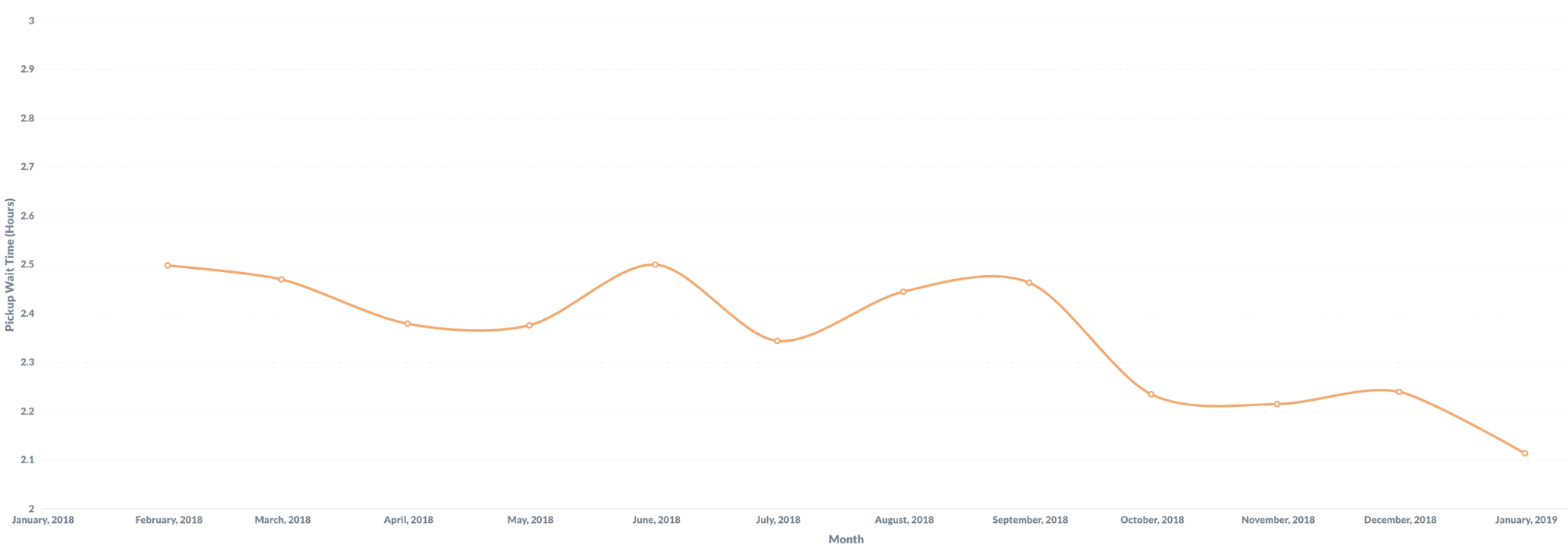

Shorter Facility Wait Times Show Slowing Demand

Convoy’s data has given us further insight into the slowing demand.

We took a look at wait times at facilities and are seeing drivers aren’t waiting as long to get loaded. While this seems like a good thing for a driver, it typically comes from less traffic from less outbound freight. Wait times are much lower than they were the same time last year.

Looking out longer term, we saw the Federal Reserve walk back the rate hike path for 2019, responding to bearish growth. We’re continuing to watch how Fed policy will affect consumer demand. We anticipate short term slowness, but a strong path over the next few years.

Supply – Capacity is Available

Seasonality and slow demand are freezing spot markets. We’re seeing tender rejection at all time lows as carriers and brokers are scrambling to accept contract freight. This is supported by DAT’s national rates.

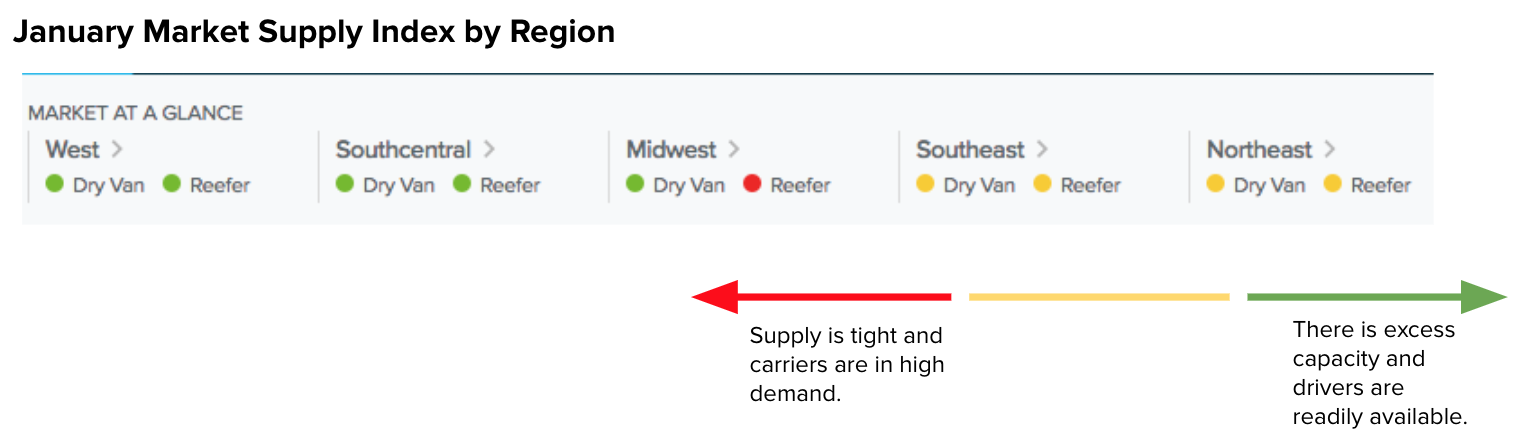

Convoy’s Market Supply Index is showing excess supply almost across the board. The main exception is Midwest reefer, where the polar vortex is forcing shippers to heat trucks to ensure products are not damaged from frost.

While demand will pick up seasonality in March through the summer, decreased demand will likely be a drag on the spot market throughout 2019. We’re seeing trucking hires increasing, but at a slower pace than in 2018.

Our Recommendations: Supply Has Slack, Take Advantage of Good Rates and Service

Shippers should be taking advantage of low tender rejection and moving all the freight they can right now, over both the contract and spot markets. These spot rate lows will not only be the cheapest for 2019, but also probably the next couple years.

Shippers – interested in learning more about our industry-leading tender compliance, on-time service, and data-driven insights? Request a demo.

Carriers should look to hold brokers and shippers accountable for contract freight to float you through these low demand periods. Make sure shippers know you’ll be there in June when demand spikes again.

Carriers – interested in a hassle-free experience, automated detention, free quick pay, and unique offerings such as Request-A-Load? Learn more, or call us at 206-202-5645