FreightWaves April Market Webinar Recap: 6 Things You Should Know

Industry Insights • Published on April 20, 2019

Thanks to all who attended FreightWaves’ April Monthly webinar sponsored by Convoy. Below, we summarize the webinar and add insights from Convoy.

Overall, demand is sluggish, but no crashes are imminent. On the carrier side, stability is holding throughout the country.

1. Tariffs: the U.S. and China are expected to sign a trade agreement toward the end of the quarter.

After nearly a year of passive back and forth, it is looking more like there will be a U.S./China tariff agreement. This is expected to be signed in late May/early June, according to reports. While some tariffs were enacted last year, all scheduled for 2019 have been postponed so far. This should clear up the trans-Pacific freight tension.

Our eyes are turned to Europe, where GDP growth is continuing to be cut and threats of auto tariffs loom overhead with limited news.

2. The Fed: Economic data is flat.

The Fed is continuing to react to incoming data, which is showing plateaus more than downturns right now. In the March Fed minutes released last week, there was light indication that this could trend to growth, which could result in a Fed Funds target raise ahead of inflationary forces.

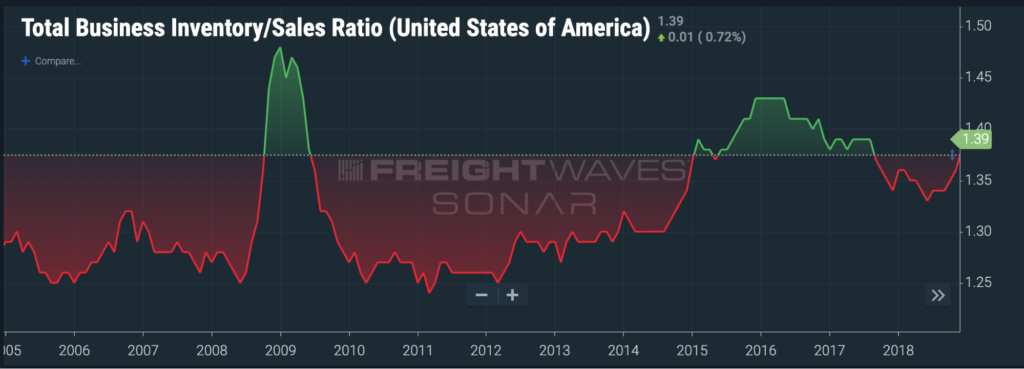

All this indicates demand is slowly becoming healthier at a macro level, and we have not felt a significant downturn. Some data is showing this struggle. Looking to The Total Business Inventory/Sales Ratio, we see an increase from lower sales, but in context, this is nothing major.

3. Wait times are also flat, indicating weakness in the freight market in March.

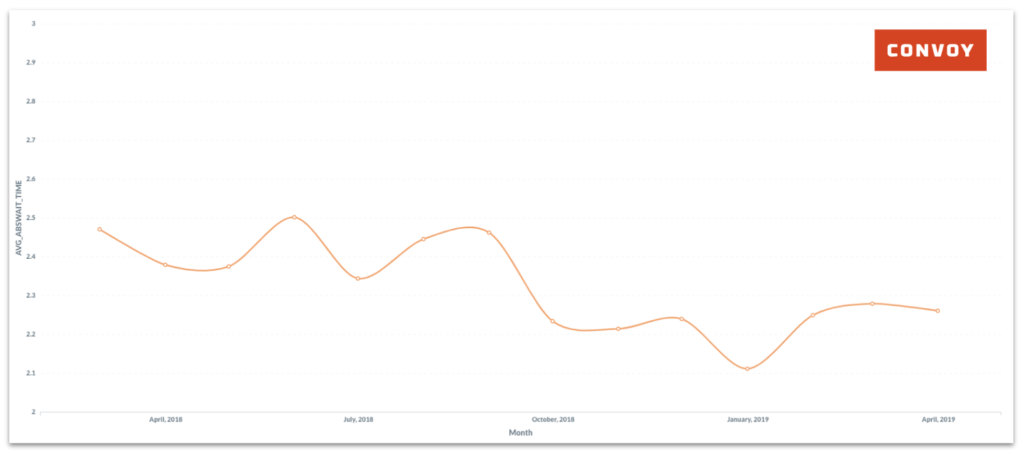

We’re continuing to monitor average wait times at facilities to measure how efficiently operations are moving.

Over the last few months, wait times have been flat. Normally, we would expect a slight slowdown in April as we begin a new quarter. However, the chart below is showing weakness in March more than April strength. We are also seeing decreases in wait times as expected in larger markets such as L.A.; Ontario, California; and Atlanta, Georgia.

4. Spot market prices and rejection rates at year-over-year lows.

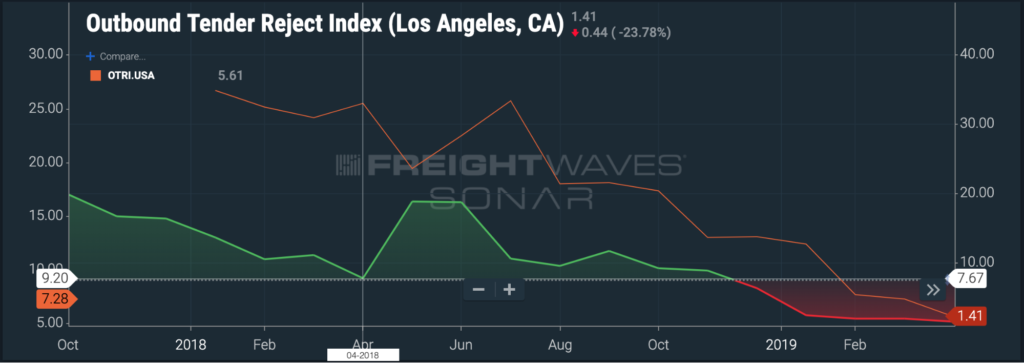

With demand slowing, the spot market prices are hitting substantial year over year lows — both in pricing and also in lack of tender rejections. Nationally, the tender rejection rate is down to almost 7%, versus over 25% at this time last year.

In hot markets like L.A., tender rejection is almost unheard of. It sits around 1.5% as shown below.

5. Trucking payrolls dropped.

We’re seeing this balance affect employment in trucking, a lagging indicator of economic health. Trucking payrolls dropped by 1,200 last month after almost a year of steady increases. This means carriers are taking advantage of slow demand and catching up after supply was a bottleneck for so long. This led to the record spot pricing last year, and it may be awhile before we see those again.

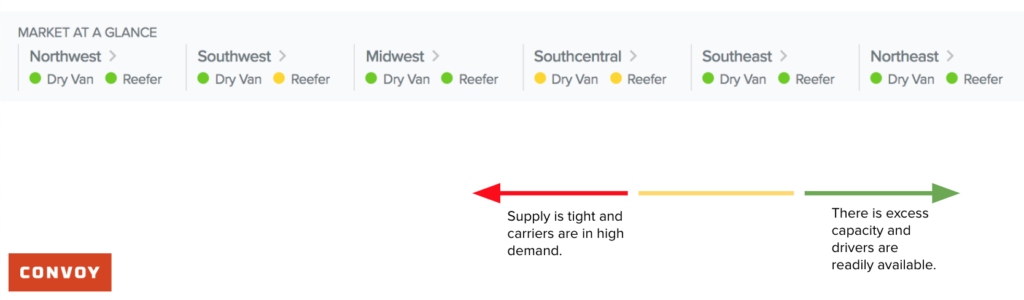

6. Supply is healthy across the nation.

Breaking down the market into regions and truck types, we see supply is relatively healthy across the board. While tender rejections are down in California, volume is up year over year. This is why guaranteed tender acceptance programs are so vital to the industry. Truck order wait times are starting to drop, but there is still a waitlist if you want a new truck. Carriers are able to meet demand, but also have more options for what loads to haul. This is especially true in South Central, where the market is fairly balanced.

Convoy leverages our unique access to driver GPS data, driver bids and shipment offers to create a picture of the market and demonstrate how easily you can book a truck at the current market rate. The Market Supply Index helps shippers understand the market at a glance and make better decisions about booking now versus later.

Our Recommendation: Build Carrier Trust While Approaching Summer

Summer is coming, so volume should pick up and spot rates should increase after Memorial Day for carriers. It’ll be here before you know it, so build good relationships with brokers or shippers now to be first in line for good freight.

Shippers should maximize volume going through the primary market so brokers and carriers will be there for you in June. Building trust with good, high-service carriers should be the priority. Good carrier and broker relationships now will save costs once seasonality starts up again in a few weeks.

Shippers – to learn more about shipping with Convoy, visit the shipper hub or contact us at (206) 971-1237.

Carriers – to learn more about hauling with Convoy, visit the carrier hub, or contact us at (206) 202-5645.