COVID-19 and Freight: What’s next for demand? Will truck supply contract?

Freight Research • Published on March 20, 2020

Earlier this week we shared our initial thoughts on the freight market given the volatile economic environment of the past two weeks. In moments of great uncertainty there is, by definition, more noise than signal. Our goal is not to add to the noise, but to simply state facts about the freight market and the economy as we see them. We hope you find them informative.

What happens next?

- Demand for consumer staples is surging, as The Wall Street Journal reports. Consumption is likely to shift toward groceries and household basics as more and more Americans are forced to stay home.

- However, the surge in demand has been neither geographically nor sectorally widespread. Demand has been driven overwhelmingly by a handful of sectors in some, admittedly populous, regions. The parts of the country that have been hit first and hardest by COVID-19 had been, until recently, the main drivers of economic and employment growth.

- The prospect of retail and manufacturing closures, social distancing measures, and rising layoffs will reduce aggregate demand in both the near term and the months ahead.

- Given these uncertainties, no one knows for sure how truckload demand will evolve over the coming weeks — more specifically, whether and how long the recent rush of demand will last. In times like these, it is particularly important to frame future expectations with a discussion of uncertainty and risk.

Will truck supply begin to contract?

- Demand alone does not make the market. There is also supply. Carriers have struggled for much of the past year in response to soft rates, rising costs and excess supply; some have gone bankrupt.

- Beyond the near-term earnings opportunity for carriers in regions where demand is currently high, there are potentially some downside risks to carrier supply. For example, truck drivers may need to stay home for health and family concerns.

- There’s a low risk that carriers would change jobs because of shifts in the labor market, as hiring is on pause across many (though not all) sectors of the economy.

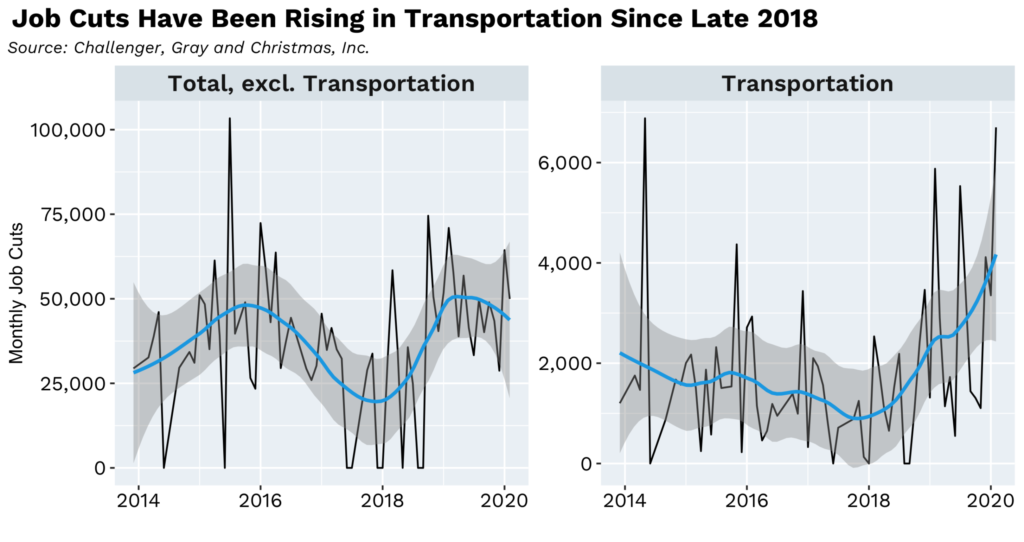

- The freight industry has experienced soft demand for much of the past year, and layoffs have been rising (as seen in this data from outplacement firm Challenger, Gray and Christmas, Inc.). The recent surge in freight is keeping many carriers busy.

How deep and how wide of a recession?

- By most estimates, the U.S. economy will contract this spring. Measuring whether the contraction lasts the full two quarters (to meet most definitions of a recession) would miss the more important point. As a society we care about recessions because of the scale of human suffering that they imply. COVID-19 has already caused a large scale of human suffering.

- The speed and strength of the eventual rebound in economic activity depends, in large part, on how long the pain of the current contraction lasts. Many economists are now predicting a V-shaped recession and recovery — meaning that the contraction will be short and deep and followed by a sharp rebound. But the contraction could be longer if bankruptcies or layoffs accelerate.

- Even if the economy does rebound quickly and sharply, periods like the present leave lasting scars: they have the potential to shift consumer preferences, particularly among teens and young adults.

We will continue to update our outlook as new data and new information comes in.

Convoy provides shippers reliable, flexible, and instant capacity when they need it most. Learn more about shipping with Convoy today.

View our economic commentary disclaimer here.